Difference between group insurance and blanket health policies – The distinction between group insurance and blanket health policies unveils a captivating narrative, inviting readers to embark on an in-depth exploration of these contrasting insurance mechanisms. Delving into their intricacies, this discourse unravels the advantages, disadvantages, and nuances that set them apart, providing valuable insights for informed decision-making.

Group insurance, a cornerstone of employee benefits packages, offers tailored coverage to groups of individuals, typically within an organizational setting. Blanket health policies, on the other hand, provide comprehensive protection to a defined population, often within a community or industry.

Understanding Group Insurance

Group insurance is a type of insurance that is offered to members of a group, such as employees of a company or members of a professional organization. It is typically provided by an employer or organization as a benefit to its members.

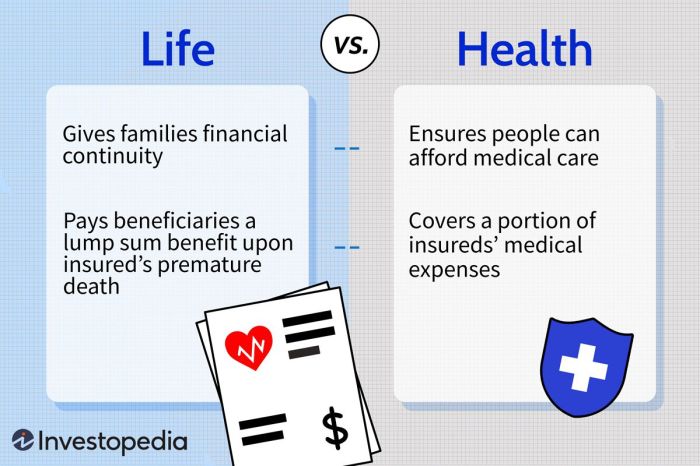

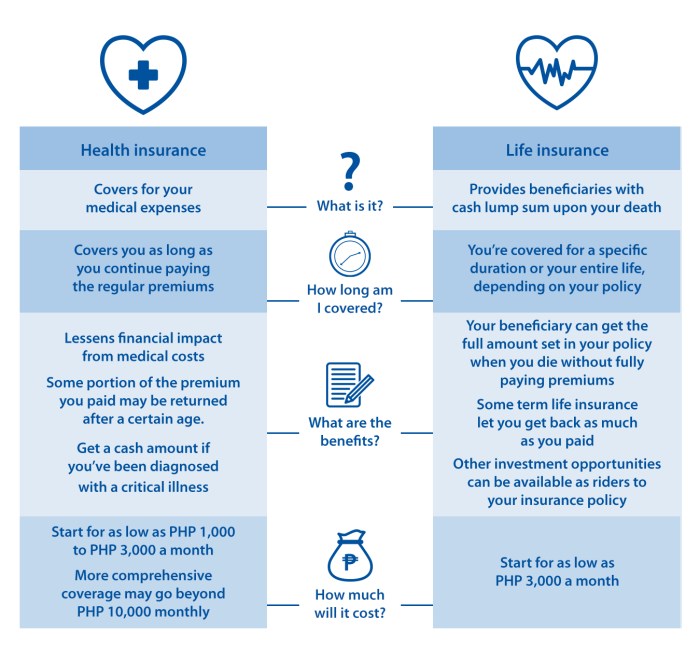

There are several types of group insurance policies, including health insurance, dental insurance, vision insurance, and life insurance. Group insurance policies can be either contributory or non-contributory. Contributory policies require employees to pay a portion of the premium, while non-contributory policies are paid for entirely by the employer.

Advantages of Group Insurance, Difference between group insurance and blanket health policies

- Lower premiums: Group insurance policies typically have lower premiums than individual insurance policies because the risk is spread across a larger number of people.

- Guaranteed coverage: Group insurance policies typically guarantee coverage for all members of the group, regardless of their health or age.

- Convenience: Group insurance policies are often offered as a benefit through an employer or organization, making it easy for employees to enroll and pay for coverage.

Disadvantages of Group Insurance

- Limited coverage: Group insurance policies may have limited coverage compared to individual insurance policies.

- Lack of flexibility: Group insurance policies are typically designed to meet the needs of the group as a whole, which may not be suitable for everyone.

- Loss of coverage: If an employee leaves the group, they may lose their coverage under the group insurance policy.

- Lower premiums: Blanket health policies typically have lower premiums than individual health insurance policies because the risk is spread across a larger number of people.

- Guaranteed coverage: Blanket health policies typically guarantee coverage for all members of the group, regardless of their health or age.

- Convenience: Blanket health policies are often offered as a benefit through an employer or organization, making it easy for employees to enroll and pay for coverage.

- Limited coverage: Blanket health policies may have limited coverage compared to individual health insurance policies.

- Lack of flexibility: Blanket health policies are typically designed to meet the needs of the group as a whole, which may not be suitable for everyone.

- Loss of coverage: If an employee leaves the group, they may lose their coverage under the blanket health policy.

- The size of the group

- The coverage needs of the group

- The budget of the group

Exploring Blanket Health Policies

Blanket health policies are a type of health insurance that covers a group of people under a single policy. This type of policy is typically used to cover employees of a small business or members of a group or organization.

Blanket health policies typically provide coverage for a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs. The coverage limits and deductibles vary depending on the policy.

Advantages of Blanket Health Policies

Disadvantages of Blanket Health Policies

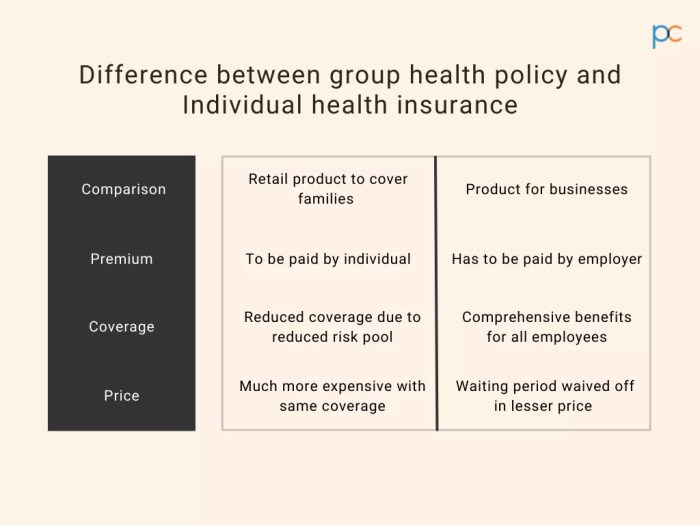

Comparing Group Insurance and Blanket Health Policies: Difference Between Group Insurance And Blanket Health Policies

| Feature | Group Insurance | Blanket Health Policies |

|---|---|---|

| Coverage | Typically provides coverage for a limited range of medical expenses | Typically provides coverage for a wide range of medical expenses |

| Premiums | Typically lower than individual insurance policies | Typically lower than individual health insurance policies |

| Eligibility | Typically offered to members of a group, such as employees of a company or members of a professional organization | Typically used to cover employees of a small business or members of a group or organization |

Group insurance policies are typically more suitable for large groups of people, such as employees of a large company. Blanket health policies are typically more suitable for small groups of people, such as employees of a small business or members of a group or organization.

Case Studies and Examples

Case Study 1:A large company offers group health insurance to its employees. The policy has a low premium and provides comprehensive coverage for a wide range of medical expenses. The employees are very satisfied with the coverage and have found it to be a valuable benefit.

Case Study 2:A small business owner purchases a blanket health policy for his employees. The policy has a low premium and provides basic coverage for a limited range of medical expenses. The employees are satisfied with the coverage and have found it to be a cost-effective way to obtain health insurance.

Best Practices and Considerations

When choosing between group insurance and blanket health policies, it is important to consider the following factors:

It is also important to compare the premiums, coverage, and eligibility requirements of different policies before making a decision.

Questions and Answers

What are the eligibility requirements for group insurance?

Eligibility for group insurance is typically determined by membership in a specific group, such as an employer, union, or professional organization.

What types of coverage are typically included in blanket health policies?

Blanket health policies often provide coverage for a wide range of medical expenses, including hospitalization, physician visits, prescription drugs, and preventive care.

Which type of policy is more cost-effective?

The cost-effectiveness of group insurance and blanket health policies varies depending on factors such as the size of the group, the level of coverage, and the specific insurance provider. It is important to compare premiums and benefits carefully to determine the most cost-effective option.